MMF is a self-funded, full cost-recovery professional Program. Financial aid is not available to students. For the 2021-2022 academic year tuition is $54,640.00 (Canadian). In addition, incidental fees are $1,769.99 (Canadian).

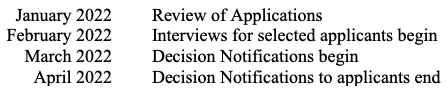

Applications for Admission in 2022 are due Dec 15th 2021.

[wpcdt-countdown id=”1509″]

We cannot accept personal visits at this time. If you have any questions, you may contact us via email at math.finance@utoronto.ca or phone at 416-946-5206.

Listen below to MMF’s most-recent Virtual Information Session from November 8th 2021:

https://open.spotify.com/episode/6MYLbhNYTliK4qEWI2xx89?si=1144f3abd6de46ae&dl_branch=1

To be considered for admission to the MMF Program, you must meet the following minimum requirements:

You must have completed a bachelor’s degree in a quantitative or technical discipline from a recognized university with a minimum GPA equivalent to a University of Toronto mid-B (75%) in the last two year of senior level courses. Use the International Degree Equivalencies Tool to see which international credentials are required for admission to MMF.

Evidence of proven ability in areas such as linear algebra, multivariable calculus, differential equations, real analysis, at least one undergraduate course in statistics that covers topics such as confidence testing, applied multivariate analysis, time series analysis and basic regression are essential. A knowledge of economics and finance is helpful to understand the context of applied mathematics as it applies to finance. The ability to use programming languages such as MATLAB; C++; R and Python are required. The ability to adapt to the technical needs of the discipline is a skill that all quants must have.

Work experience is not a requirement for admission but in a highly competitive field, the demonstration of past work experience will make you more attractive to prospective employers.

If you are a first-time applicant, Create an Account to begin your application. You will receive a verification code via email as part of the account creation process. After entering your verification code, you will create a password for your account. You may save and return to the application at any point in the process. To view the status of your application, including outstanding requirements, log in to your account to view your applicant status portal.

MMF is a self-funded, full cost-recovery professional Program. Financial aid is not available to students. For the 2021-2022 academic year tuition is $54,640.00 (Canadian). In addition, incidental fees are $1,769.99 (Canadian).

Please follow all application instructions carefully. A complete application consists of the following:

The Application Form

The application form and all supporting documents must be submitted on-line though the application portal. In addition, you must pay the application fee ($230.00 Canadian) in order for your application to be considered. The application fee must be paid by the deadline of December 15 2021. No application will be considered if either a supporting document or the application fee is received after the deadline. Please note that application fees are non-refundable.

The Application Essay

Provide your written response to the following to complete your Application Essay:

Describe your motivation for pursuing a master’s degree in Mathematical Finance.

How will your previous academic and/or professional experience help you succeed in the Mathematical Finance Program?

Describe your post-graduate career goals and 5 year career plan.

Electronic Transcripts

Provide transcripts from all post secondary institutions attended whether or not a degree was obtained. All transcripts must be uploaded to the application portal. Please note that certificates are not considered academic degrees and should not be uploaded in this section. You may note any certificates or professional designations on your CV.

Letters of Reference

Referees should be Professors or Supervisors. You will be required to enter information for 2 referees. Your referees will automatically receive a notification email that they have been requested to complete a reference for your application, along with instructions to submit their reference letter in the application system. If you need to change your referees, please get in touch with the Graduate Office. If you need to send a reminder email to your existing referees, you can do so through your applicant portal after submitting your application.

CV

This should be a current outline of your academic and professional accomplishments. Areas that should be listed are your education, work experience, professional certifications or designations, publications and other honours if applicable.

Test of English as a Second Language

International applicants may be required to submit a recognized test of English as a Second Language. Scores must be submitted at the time of application. Your application will not be considered unless you have successfully met this requirement.

Application Deadline (Application and ALL Supporting Documents)

December 15, 2021 at 11:59pm EST

All our courses are developed specifically for the MMF Program and are compulsory. Our courses are taught in our dedicated classroom and open only to MMF students. Our timetable is independent of the University of Toronto’s regular academic calendar. Courses in the MMF Program fall into three academic terms: Fall, Winter, and Summer. Courses begin in the third week of August and end in July of the following year.

Click on any course title below to read its description.

FALL SEMESTER

This course will introduce you to fundamental concepts inherent in financial systems. In order to discuss some of the most important concepts currently debated in finance, for example, “Main Street vs Wall Street”, Central Bank Digital Currencies etc. The course will discover the connections between financial institutions and economic well-being; examine the critical role of healthy banks, efficient asset markets and monetary policy. The course will also examine how commercial banks operate, examine the sources from which banks acquire their funds and how they use the funds they acquire, as well as how assets and liabilities function within banks. Commercial banks facilitate borrowing and lending, which provide valuable services to each party. Once these fundamentals are introduced, the course will explore stock market bubble and how asymmetric information affects financial markets. All of these topics will allow the student to understand and explore the impact of the recent global pandemic on markets and other critical discussion topics. (4 Lectures)

This course will use real data for analysis of time series and teach students how to capture and analyze data. These are skills students will find immediately useful in industry. By the end of the course students should have an introductory knowledge of Excel VBA and Matlab programming, sufficient to use them as tools for the remainder of the MMF program, as well as an introduction to R. Additionally, students will be introduced to financial data sets and data providers, the challenges of managing large financial data sets from differing sources, the principles and challenges of back-testing strategies with historical data sets, and an overview of the modern markets from which the data is derived. (4 Lectures)

This course will provide an introduction to global financial markets and risk management and progress to examine fixed income securities; financial derivative products in the form of Forwards and Futures and then expand into Options, Swaps and Swaptions. Students will gain knowledge by creating a portfolio with asset classes including equities, foreign exchange commodities and fixed income securities. Students will also explore practical benchmark indices used to measure portfolio performance and describe these benchmarks using algorithms and mathematical proof to support and measure the performance of the portfolio. (4 Lectures)

Over the past decade, data science and machine learning have gained immense popularity in many scientific disciplines. The reason for the emergence is due to theoretical advances in machine learning, availability of big data, and surges in computational capabilities. This course provides an introductory overview of data science methods in finance, investments, and risk management. The course covers a review of foundational probability and statistics, brief introduction to machine learning (supervised learning, unsupervised learning) and big data tools. (8 Lectures)

This course focuses on financial theory and its application to various derivative products. A working knowledge of basic probability theory, stochastic calculus, knowledge of ordinary and partial differential equations and familiarity with the basic financial instruments is assumed. The topics covered in this course include, but are not limited to: discrete time models; continuous time limit; equity derivatives; the Greeks and hedging; interest rate derivatives; foreign exchange; stochastic volatility and jump modelling and numerical methods. (13 Lectures)

The course provides an overview of key concepts in Probability Theory and Stochastic Analysis, particularly with a view of various applications in Finance. The format will be a mixture of lectures and in-classroom discussions of the theory and its applications. (13 Lectures)

The intent of this course is to introduce the students to contemporary risk management concepts used by Canadian banks as well as many global financial institutions. By the end of the course, students should have a rudimentary understanding of how Canadian banks manage risk, including familiarity with industry standard terminology, methodologies, and modelling techniques. Topics covered will include: What is a credit risk scorecard? Model development; common statistical measures and benchmarks; portfolio metrics (VaR/Expected Shortfall); Limits and governance; Controls on liquidity risk; Treasury risk management tools and analysis, climate risk analytics and enterprise-wide stress testing. (6 Lectures)

Quantitative finance is applied in the industry mostly through software implementations of computational algorithms. Often, the mathematical methods employed involve more or less sophisticated methods; the accuracy, speed and resource consumption of such algorithms often mark the difference between a business workflow which is productive, useful and economic and others which are slow, inefficient, resource intensive or simply inaccurate and therefore potentially useless. With the introduction of data science, machine learning and other methods from artificial intelligence into the realm of mathematical finance, computational challenges are increasing due to the larger computational ambition of new algorithms and the expansion of traditional business lines, aligning innovation and discovery of efficient numerical methods with the development of new business lines. This course will develop best practices in the design of numerical methods for the efficient design of computational algorithms across a wide scope of mathematical implementations, ranging from the traditional areas of computational algebra and differential equations to the newer ones of computational graph theory and optimization. (9 Lectures)

The course will cover machine learning from both a theoretical and practical point of view, with a focus on pragmatic applications & real industry examples. Topics will cover supervised & unsupervised learning, as well as high level workflows from business problem definition down to analysis and integration with business strategy. Students will be encouraged to understand problems from a quantitative point of view, as well as through the lens of strategy and business usage. The course will cover theory, applications & common usage of key machine learning techniques, as well as case studies from the financial and professional services industries. The course evaluation will be based on participation and a group project, where students will be encouraged to apply a range of techniques covered to a business problem selected by each student with the instructor’s approval. (5 Lectures)

This course is designed to assist students in their professional development by enhancing their communication skills through a combination of lectures and seminars including interview techniques; résumé preparation; the art of communication is discussed through lectures and practiced through practical assignments. Assignments are integrated with other courses and the internship component of the program. (Continuous Course)

WINTER INTERNSHIP AND SPRING SEMESTER

The internship is a course requirement for completion of the degree. Students complete their four-month full-time internship from January to April each year with an approved industry partner. During their internship, students will work on a project in their placement and at the end of the internship students give an oral presentation to the Director and the class. (4 Months)

This course will focus on optimization models and methods useful for quantitative finance. In particular, linear, robust, scenario-based, non-linear, and integer programming models and their solutions techniques will be studied. (8 Lectures)

This course examines topics in finance using the case study method. Topics covered include: firm evaluation; hedging strategies and policies; financial engineering and real options. The objective of the course is to provide real examples to reinforce important concepts and to develop analytical skills. (4 Lectures)

This course examines Operational Risk: Measurement and Management. Consider operational risk as risk arising from possible shortcomings in the routine operations of an entity. The emergence of banks acting as large-volume service providers, deregulation, globalization and advances in technology have increased the complexity of bank activity and of their risk profile. Through the use of case study, this course will examine the Basel framework; database management, risk maps and new regulatory trends. (4 Lectures)

This course focuses on capital adequacy and capital management. Examining the New Basel Accord; Banking Capital Management; Credit Risk Requirements and Market Risk Requirements. Students will study Counterparty credit risk completing a report and presentation deck. (5 Lectures)

This course teaches how institutional investors manage assets to meet their long-term objectives while subject to short-term constraints. Examples of institutional investors are endowments, pension plans, and sovereign wealth funds. A focus is on how an investor can add value above a benchmark portfolio. By the end of the course, students should be able to fairly evaluate investment performance, construct a prudent portfolio tailored to a specific investor, and make investment decisions based on sound analysis. (8 Lectures)

The equity, FX and equity option trading workshop is designed primarily to help students understand the basics dynamics of trading, but from a market makers perspective. It also provides a broad practical overview of the structure and trading mechanisms of the equity, FX and option markets, and provides practical insights into the management of risk, especially option risk. Students will trade and manage the risk of equity, FX and option trading books using the proprietary ICTrader.

(5 Lectures)

This course begins with a review of the business elements that drive financial products and the mathematical tools needed to model them. The list of mathematical models includes a variety of time series frameworks, allowing for asymmetry, fat-tails and jumps, and will include forecasting techniques. The financial products included will include fixed income, volatility, options and risk premia and their use within different business environments, notably treasury and portfolio management. (5 Lectures)

The objectives in this course are to develop a deeper, practical view of risk and portfolio management. To extend students’ understanding of quantitative risk models and techniques. In addition, to move beyond risk measurement: risk management, portfolio management and understanding implementations of a risk and portfolio system. (8 Lectures)

Few technological concepts have captivated minds like Blockchain has since the dot.com bubble in the late 1990s. There is a lot of hype around Blockchain and cryptocurrencies like Bitcoin, and the potential impact this technology has on society. The course provides an introduction of blockchain–focused on fundamental concepts exploring a range of stakeholder perspectives, governance and implementation challenges as the race to adopt begins. It will provide students from all backgrounds with the knowledge of the core concepts of blockchain, preparing students for more advanced and in depth courses on blockchain. Students will leave with a starting point on how to implement blockchain in their organizations and businesses. (5 Lectures)